Wrap Around Mortgage Rider free printable template

Show details

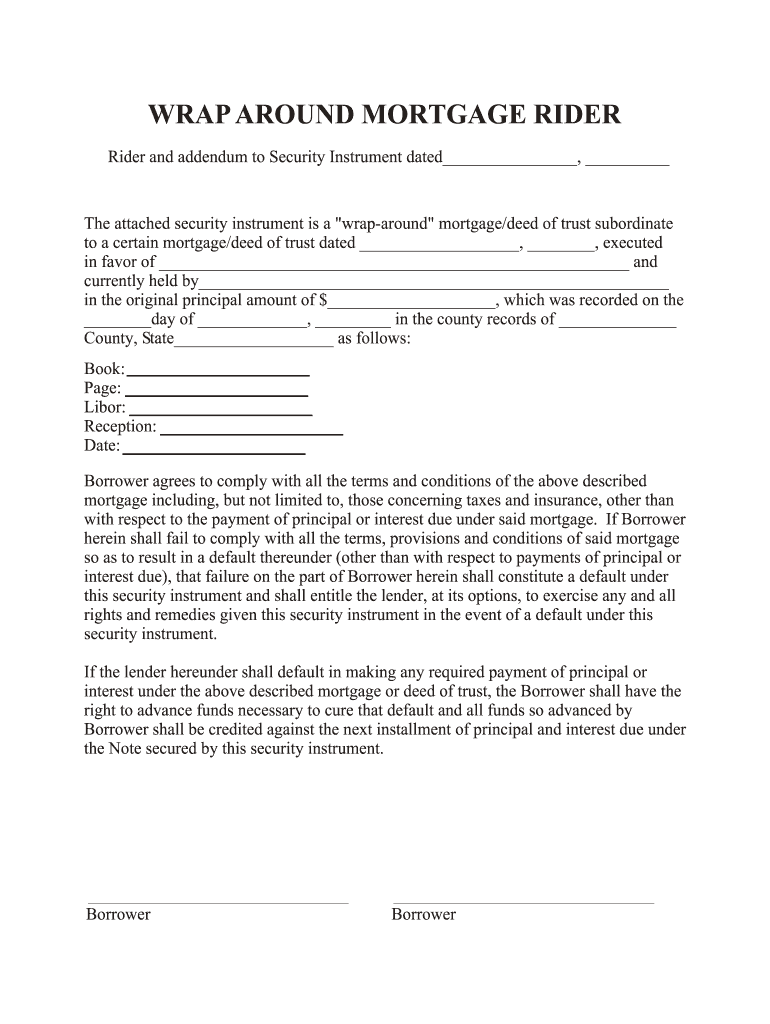

WRAP AROUND MORTGAGE RIDER and addendum to Security Instrument dated, The attached security instrument is a wrap-around” mortgage/deed of trust subordinate to a certain mortgage/deed of trust dated,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wrap around mortgage forms

Edit your wrap around contract form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wrap around mortgage package word document form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wrap around mortgage contract online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage around form wrap. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wraparound mortgage form

How to fill out Wrap Around Mortgage Rider

01

Review the existing mortgage documents to understand the current loan terms.

02

Prepare a new mortgage agreement that includes the terms of the wrap around loan.

03

Specify the total amount of the original mortgage and the new wrap around loan.

04

Clearly outline the interest rates, payment schedule, and any terms of late payment.

05

Detail the duration of the wrap around mortgage in the rider document.

06

Include clauses that address any potential default scenarios.

07

Ensure both parties (the seller and the buyer) initial or sign each page of the rider.

08

File the signed rider with the local county clerk or relevant authority to make it enforceable.

Who needs Wrap Around Mortgage Rider?

01

Home buyers purchasing property while assuming the sellers' existing mortgage.

02

Sellers looking to sell their property while still retaining their current mortgage terms.

03

Real estate investors seeking to finance acquisitions without new loans.

04

Individuals looking to negotiate favorable loan terms when traditional financing is not an option.

Fill

documents to wrap mortgage

: Try Risk Free

People Also Ask about wrap around deed of trust texas

What is the main advantage of a wraparound mortgage?

The main benefit of a wraparound mortgage is the ability for an investor to purchase property, even if they have poor credit.

What is the benefit of a wrap around mortgage?

For the Seller Potential for profit: Sellers can charge a higher interest rate than the one they have, which earns them a monthly profit. Widens the buyer pool: Offering a wraparound mortgage as a financing option can make the sale more accessible to some buyers since it's more flexible and easier to qualify for.

What is the purpose of a wraparound loan?

Wraparound mortgages are used to refinance a property and are junior loans that include the current note on the property, plus a new loan to cover the purchase price of the property. Wraparounds are a form of secondary and seller financing where the seller holds a secured promissory note.

What is a wraparound mortgage a form of?

A wraparound mortgage, also known as a carry-back loan, is a form of owner or seller financing. The buyer gets a mortgage that includes, or “wraps around,” the existing mortgage the seller has on the property.

What is a wrap around agreement?

A wraparound mortgage, not like other mortgage contracts, is a seller financing option, where, when the new buyer fails to make the payments, the seller has the right to take back the real estate property. The sellers lending institution can also foreclose on the property in case both parties completely default.

Is a wrap around mortgage legal?

Are Wraparound Mortgages Legal? Wraparound mortgages are generally considered to be legal. However, they are less commonly used in the real estate market due to several factors. One of these considerable factors is the increased inclusion of “due on sale” clauses in many mortgage agreements.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get wrap around deed of trust form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific wrap around mortgage contract form and other forms. Find the template you need and change it using powerful tools.

Can I sign the wrap around mortgage example electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out mortgage document template using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign wrap around mortgage and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is Wrap Around Mortgage Rider?

A Wrap Around Mortgage Rider is a financing arrangement that allows a new mortgage to encompass an existing mortgage, enabling a seller to finance the purchase of a property while keeping the original mortgage in place.

Who is required to file Wrap Around Mortgage Rider?

Typically, the seller who is financing the buyer's purchase of the property is required to file a Wrap Around Mortgage Rider.

How to fill out Wrap Around Mortgage Rider?

To fill out a Wrap Around Mortgage Rider, the parties involved need to provide details such as the existing mortgage terms, the new mortgage amount, interest rates, payment schedule, and all parties' signatures.

What is the purpose of Wrap Around Mortgage Rider?

The purpose of a Wrap Around Mortgage Rider is to facilitate the financing of a property transaction by allowing the new mortgage to 'wrap around' the existing mortgage, enabling sellers to attract buyers who may have difficulty securing traditional financing.

What information must be reported on Wrap Around Mortgage Rider?

Information that must be reported on a Wrap Around Mortgage Rider includes the existing loan details, new loan amount, interest rate, repayment terms, due dates, and parties' identifying information.

Fill out your Wrap Around Mortgage Rider online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wraparound Mortgage Example is not the form you're looking for?Search for another form here.

Keywords relevant to mortgage note and any applicable riders

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.